Originally published on February 26, 2025 | Last updated on April 22, 2025

You’ve arrived in New Zealand and bought your car now (after reading my guide to buying a used car as a WHV holder!). Now you wonder about getting a car insurance in New Zealand! Don’t worry – in this guide I’ll go through my experience of going through major car insurance companies in New Zealand one by one. I promise that you’ll come out of this post being fully confident in getting a car insurance that suits your budget and daily needs, all without confusion!

Do you need car insurance in New Zealand?

Yes and no. Car insurance is not mandatory in New Zealand (which I think is bonkers!). However, it is a good idea to purchase one. I can’t find the exact statistics for road accidents but I think that people drive worse in NZ compared to the UK (sorry, NZ!). People don’t really respect the speed limit or give way signs as much, and either stop for too long in roundabouts or jump too closely. I have to pay more attention driving here than the UK. When I look at cars, they tend to have many bumps and dents on them.

New Zealand Immigration highly recommends to get a third party insurance as a minimum, which I highly agree. In fact, I just bought a third party insurance premium, so we’ll talk about that soon to help you.

How much is car insurance in New Zealand?

I find car insurance in New Zealand to be infinitely cheaper than the UK. The average car insurance cost in the UK is £834 (1,839.78 NZD according to Google). Meanwhile, average NZ car insurance cost is NZ$1,325. Obviously, the car insurance massively depends on your age, location, and many other factors. The best thing to do is to enter your information and compare the quotes.

Do I need Comprehensive or Third Party Insurance?

Well, ultimately it is up to you. I can tell you how I decide on third party only insurance though. Insurance is basically to help you with unexpectedly big expenses. Comprehensive insurance is to insure your car itself. Third party insurance, is to insure the damage that may happen to another person or property in an incident. There is also a third option which is third party, theft and fire which is basically third party insurance but will cover you in the event of theft or your car being caught on fire.

We bought a used secondhand car for not very much, so I don’t think it’s that much to choose a comprehensive insurance. But I want to be insured in the case of getting in a car accident with other people, which is quite likely in New Zealand and possibly more likely as a foreign drivers, though we cannot be sure.

What is the most trusted insurance company in New Zealand?

There are many big car insurance company in New Zealand, namely AA, AMI, Cove, State, Tower – these are the most common I’ve came across. Banks also seem to provide car insurance (for example ANZ). Even TradeMe offers car insurance! It takes a few seconds to Google and possibly there are many more that I’ve not listed here.

Who is the cheapest car insurance? My Experience

Right, so I’ve just got my own car insurance, so how about we go through all my quotes and I’ll share my experience. Please remember that you won’t get the same price as I do, as we are 2 different people with 2 different circumstances!

AMI: Cheap but Wont Offer for Visa Holders <1 year

Practise what you preach, so I put my details to AMI to get a car insurance. I got $16.8 a MONTH, INCLUDING roadside rescue. Damn that’s cheap.My insurance in the UK is about £50 per MONTH so that’s NZ$110-ish, though that’s for comprehensive. Just for fun, the quote for comprehensive car insurance is $84.57 per month. Still cheaper, but yeah not as cheap as third party insurance. The roadside insurance was $49 per year by the way.

However, I noticed it asked whether I am a permanent resident or I have a visa for more than 12 months. My working holiday visa is only for 1 year, so I clicked no. A popup asked me to call their call service. I did, and while the wait was long, the lady behind the call was very sweet and very respectful.

After A WHOLE DAMN HOUR giving my details, she told me that they couldn’t offer me an insurance!! Apparently they need my visa to be valid for the next 12 months from the start date of the car insurance. She was very apologetic and it sounded like someone above her refused the insurance, so I tried to not be too angry about it. I also tried to say that the visa can be extended more than 12 months, but nope they wont budge.

Moral of the story: if your visa is for a year or less, don’t bother getting a quote from AMI.

State: same verdict as AMI on Visa Holders <1 Year

I tried to get a quote from State, but once it got to the question whether I’m “a permanent resident or hold a visa for more than a year” I just closed the tab. Too traumatised from AMI.

Cove: only offers comprehensive

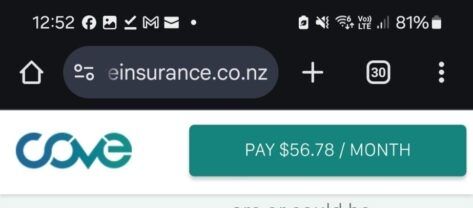

I got a quote from Cove for $53.03 per month or $520.83 yearly, $56.76 with roadside assistance. It was a big confusing at first as I didn’t see anywhere the option to pick comprehensive or third party insurance so I went back. I missed a sentence in the beginning that says they only offers comprehensive. Cheaper than AMI comprehensive it seems though.

Tower: the most expensive option so far!

Tower offered me $29.56 per month for third party or $96.31 per month for comprehensive. I can add $1.84 per fortnight (every 2 weeks) for roadside assistance. I saw that quote and closed the tab lol.

AA: the most unexpected quote!

AA seems to be a big name and someone on Reddit complained that they were expensive, so I dismissed them at first. However, since I couldn’t get the car insurance from AMI or State due to the entire visa debacle, I thought hey why not try it. And they gave me $21.06 per month for third party insurance! I ended up purchasing the AA insurance at the end.

The only downside to AA insurance is they don’t include the roadside assistance, as they want you to buy the AA membership. I’ll cover roadside assistance next time but you can definitely pay separately for roadside assistance which is what I did.

The Verdict : The Best and Cheapest Car Insurance in New Zealand

AA! Does that surprise you? It definitely did surprise me! I haven’t used them at all though so I can’t comment whether they are good or not if I need a claim. I hope I never have to use it though.

You may want to read my cost of living blog post, complete with receipts if you haven’t!

One thought on “The Ultimate Guide to Buying New Zealand Car Insurance for Working Holiday Visa Holders!”